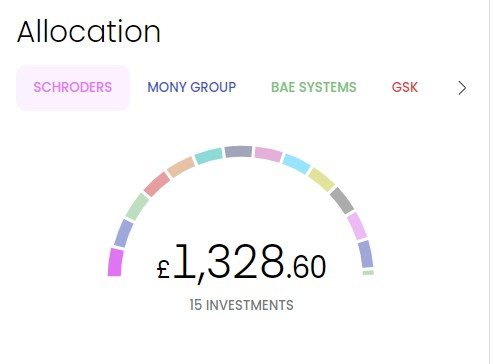

I have started building my passive income portfolio by investing £1,325 in UK stocks that pay dividends. Take a look at the portfolio that I have created.

Getting Paid Every Month Of The Year

My goal is to build a dividend-paying, passive income portfolio that pays me every month. It does not matter how small the amounts are, but I want to get paid every month. Once I have achieved this, I will focus on increasing my dividend earnings.

I have looked at the months that UK-based stocks pay dividends to find 14 companies to invest in…

January

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| GSK | GSK | Pharmaceutical | 4.16% |

| British American Tobacco | BATS | Cigarettes, Tobacco, Vapes | 8.79% |

February

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| United Utilities | UU | Water Supply | 4.87% |

| Sage | SGE | Accounting Software | 1.97% |

| Primary Health Properties | PHP | Healthcare Properties (REIT) | 6.70% |

March

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| Unilever | ULVR | Consumer Goods | 0.01% |

| IG Group | IGG | Financial Services | 5.01% |

| AstraZeneca | AZN | Pharmaceutical | 0.01% |

April

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| GSK | GSK | Pharmaceutical | 4.16% |

| British American Tobacco | BATS | Cigarettes, Tobacco, Vapes | 8.79% |

| Rio Tinto | RIO | Mining | 5.58% |

May

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| Primary Health Properties | PHP | Healthcare Properties (REIT) | 6.70% |

| MONY Group | MONY | Price Comparison Website | 5.75% |

| Legal & General | LGEN | Insurance Services | 9.19% |

| Admiral Group | ADM | Insurance & Financial Services | 1.30% |

| Schroders | SDR | Investment Management | 6.00% |

June

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| Sage | SGE | Accounting Software | 1.97% |

| Unilever | ULVR | Consumer Goods | 0.01% |

| BAE Systems | BA | Defence, Aerospace & Security Solutions | 2.33% |

July

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| GSK | GSK | Pharmaceutical | 4.16% |

August

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| British American Tobacco | BATS | Cigarettes, Tobacco, Vapes | 8.79% |

| Primary Health Properties | PHP | Healthcare Properties (REIT) | 6.70% |

| United Utilities | UU | Water Supply | 4.87% |

September

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| MONY Group | MONY | Price Comparison Website | 5.75% |

| Unilever | ULVR | Consumer Goods | 0.01% |

| Legal & General | LGEN | Insurance Services | 9.19% |

| Rio Tinto | RIO | Mining | 5.58% |

| Schroders | SDR | Investment Management | 6.00% |

| AstraZeneca | AZN | Pharmaceutical | 0.01% |

October

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| GSK | GSK | Pharmaceutical | 4.16% |

| Admiral Group | ADM | Insurance & Financial Services | 1.30% |

| IG Group | IGG | Financial Services | 5.01% |

November

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| British American Tobacco | BATS | Cigarettes, Tobacco, Vapes | 8.79% |

| Primary Health Properties | PHP | Healthcare Properties (REIT) | 6.70% |

| BAE Systems | BA | Defence, Aerospace & Security Solutions | 2.33% |

December

| Company | Symbol On Trading 212 | Industry | Dividend Yield |

|---|---|---|---|

| Unilever | ULVR | Consumer Goods | 0.01% |

Some of the dividend yields are relatively low, but my objective is to cover every month. I want to get paid passive income in all 12 months of the year.

I will get a high amount of dividends in some months, other months will bring in lower payments. My goal is to get an average of over 4% in dividend earnings.

I am using Trading 212 to invest in dividend-paying stocks to build my passive income portfolio. I have set a 12-Step Goal to enable me to replace the earnings from my current employment using passive income from my dividend stocks portfolio.

Do you want to get free shares worth up to £100? Join Trading 212 Invest with my link, and we will both get free shares.

Dividend Paying Stocks That I Have Invested In

I have invested in the following 14 UK based dividend-paying stocks…

I have invested £100 in GSK. Some key information on GSK (GSK):

- Global Healthcare Company: GSK is a multinational pharmaceutical company focused on developing vaccines, medicines, and consumer healthcare products. It operates across three main areas: Pharmaceuticals, Vaccines, and Consumer Healthcare.

- Strong Vaccine Portfolio: GSK is one of the world’s largest vaccine manufacturers, producing vaccines for conditions like hepatitis, influenza, meningitis, and shingles. Their vaccine development, especially in respiratory and infectious diseases, is a core strength.

- Spin-off of Consumer Healthcare: In July 2022, GSK completed the demerger of its consumer healthcare business into a new company, Haleon. This move allows GSK to focus on pharmaceuticals and vaccines, with a renewed emphasis on innovation and R&D.

- Focus on Respiratory and HIV Treatments: GSK has a strong portfolio in respiratory diseases, particularly with products for asthma and chronic obstructive pulmonary disease (COPD). It is also a leader in HIV treatment through its subsidiary, ViiV Healthcare.

- Commitment to R&D: GSK invests heavily in research and development, with a focus on areas such as oncology, immunology, and infectious diseases. The company aims to strengthen its pipeline with next-generation medicines, particularly in the oncology space.

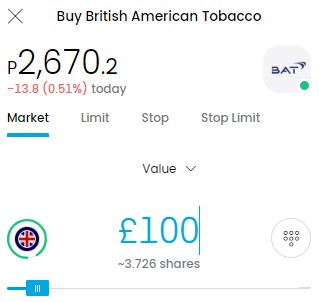

I have invested £100 in British American Tobacco. Some key information on British American Tobacco (BATS):

- Global Market Presence: British American Tobacco is one of the largest tobacco companies in the world, with operations in over 180 countries. It markets well-known cigarette brands like Dunhill, Lucky Strike, Pall Mall, and Rothmans.

- Shift Toward Reduced-Risk Products: In recent years, BAT has been diversifying into non-combustible products like vapor (Vuse), tobacco heating products (glo), and oral nicotine (Velo) as part of its “A Better Tomorrow” strategy to reduce health impacts from smoking.

- Strong Dividend Stock: BAT is known for its consistent and attractive dividend yields, making it a popular choice among dividend and income-focused investors.

- Regulatory Challenges: The company faces significant regulatory challenges, especially with increasing health-related restrictions on traditional tobacco products and potential bans on certain newer nicotine products.

- Resilient Financial Performance: Despite the global decline in smoking rates, BAT has maintained strong revenues and profitability, primarily due to its premium brands, pricing power, and growing portfolio of reduced-risk products.

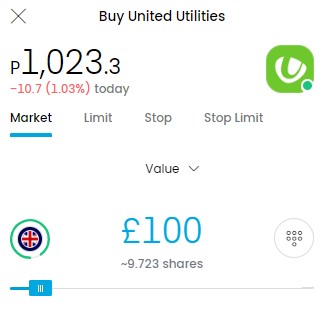

I have invested £100 in United Utilities. Some key information on United Utilities (UU):

- Water and Wastewater Services: United Utilities is the largest listed water company in the UK, providing water and wastewater services to the North West of England, serving approximately 7 million people and 200,000 businesses.

- Regulated Business Model: The company operates under a regulated business model, overseen by Ofwat (the Water Services Regulation Authority). This ensures a stable revenue stream but also requires adherence to strict regulatory frameworks and performance targets.

- Sustainability Focus: United Utilities places a strong emphasis on environmental sustainability. It has invested heavily in reducing water leakage, increasing water recycling, and improving overall water management systems to meet the UK’s stringent environmental goals.

- Dividend Payments: United Utilities is known for its consistent dividend payments, making it an attractive option for income-focused investors. The company has a policy of providing inflation-linked dividend growth, making it a favourite among dividend investors.

- Long-Term Capital Investment: The company invests heavily in infrastructure improvements, ensuring the long-term reliability of water and wastewater services. Over the next few years, United Utilities plans to continue significant capital expenditures to enhance its infrastructure and meet growing demand.

I have invested £100 in Sage. Some key information on Sage (SGE):

- Leading Global Software Company: Sage Group PLC is one of the world’s largest suppliers of enterprise resource planning (ERP) software and accounting solutions for small and medium-sized businesses (SMBs).

- Strong Focus on Cloud Solutions: In recent years, Sage has transitioned towards cloud-based software solutions, offering its flagship product, Sage Business Cloud, which provides accounting, payroll, and payment services to SMBs.

- Recurring Revenue Growth: Sage has a significant portion of its revenue from subscription-based services, with a growing emphasis on increasing recurring revenue from cloud-based solutions.

- Global Reach: The company operates in over 20 countries, with a strong presence in Europe, North America, and Africa, catering to a diverse range of industries.

- Dividend-Paying Stock: Sage has a history of paying consistent dividends, making it attractive for income-focused investors. The company’s strong cash flow generation supports its ability to return value to shareholders.

I have invested £100 in Primary Healthcare Properties. Some key information on Primary Healthcare Properties (PHP):

- Specialized Real Estate Investment Trust (REIT): PHP focuses on investing in primary healthcare facilities, particularly General Practitioner (GP) surgeries and modern healthcare centers across the UK and Ireland.

- Stable Long-term Leases: PHP benefits from long-term, government-backed leases with healthcare providers like the National Health Service (NHS), providing consistent and secure rental income.

- Defensive and Stable Business Model: Due to the essential nature of healthcare, PHP has a resilient business model, making it a relatively defensive investment even during economic downturns.

- Strong Growth Strategy: PHP continues to grow through acquisitions and the development of modern, purpose-built healthcare facilities, often expanding into underserved regions.

- Sustainable Dividend Growth: PHP has a track record of delivering reliable and growing dividends to its shareholders, supported by stable rental income and prudent management of its property portfolio.

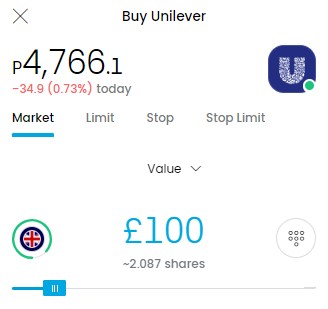

I have invested £100 in Unilever. Some key information on Unilever (ULVR):

- Diverse Product Portfolio: Unilever owns a wide range of well-known brands across categories like food & beverages (Knorr, Lipton), personal care (Dove, Axe), and home care (Omo, Surf). This diverse portfolio helps mitigate risk across different markets.

- Global Presence: Unilever operates in over 190 countries, with significant market share in both developed and emerging markets. Its global scale allows it to capitalize on growth opportunities and weather local economic fluctuations.

- Sustainability Focus: Unilever is a leader in sustainability efforts, with its “Sustainable Living Plan” aimed at reducing environmental impact, improving health and well-being, and enhancing livelihoods across its supply chain.

- Dividend Aristocrat: The company has a strong track record of paying reliable dividends, making it attractive to income-focused investors. Unilever has consistently paid dividends for decades, positioning it as a stable choice for dividend investors.

- Challenges with Growth and Competition: Unilever faces significant competition from both large multinational companies like Procter & Gamble and Nestlé, and smaller, niche brands, which can limit growth potential in certain markets. Rising costs and supply chain issues are also challenges.

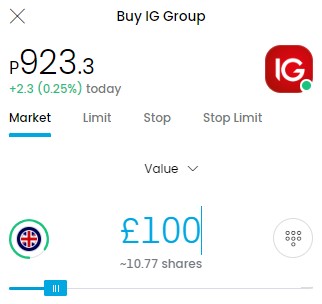

I have invested £100 in IG Group. Some key information on IG Group (IGG):

- Market Leader in CFD and Spread Betting: IG Group is a global leader in online trading, specializing in Contracts for Difference (CFD) trading and spread betting. It offers a wide range of financial products, including shares, forex, commodities, and cryptocurrencies.

- Global Presence: The company operates in more than 15 countries and serves over 240,000 clients globally, providing access to over 17,000 financial markets.

- Strong Financials: IG Group consistently delivers strong financial results, boasting a high operating margin and solid revenue growth, driven by its diversified business model and consistent client activity.

- Regulated and Trusted: IG Group is regulated by top-tier financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), which enhances its credibility and trustworthiness among clients.

- Innovative Platform and Technology: The company is known for its advanced trading platform, featuring powerful analytical tools, research, and risk management features, attracting both retail and professional traders.

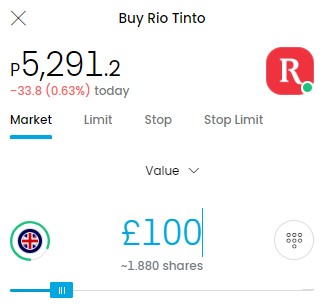

I have invested £100 in Rio Tinto. Some key information on Rio Tinto (Rio):

- Global Mining Giant: Rio Tinto is one of the world’s largest mining companies, with operations across six continents, focusing on extracting essential minerals and metals, such as iron ore, aluminum, copper, and diamonds.

- Iron Ore Dominance: The company is a major player in the global iron ore market, particularly in Australia, where it operates large mines in the Pilbara region, contributing significantly to global steel production.

- Sustainability Initiatives: Rio Tinto is investing heavily in sustainable practices, aiming for net-zero carbon emissions by 2050. It focuses on reducing its environmental footprint through renewable energy projects and reducing waste in mining processes.

- Strong Financials and Dividends: Known for its strong balance sheet and cash flow, Rio Tinto has consistently returned capital to shareholders, making it attractive to dividend and value investors. It offers regular dividends, often with special payouts.

- Geopolitical and Operational Risks: Despite its scale, the company faces challenges, including geopolitical tensions, regulatory changes, and environmental opposition, which can affect its operations, particularly in regions with strict environmental and labour laws.

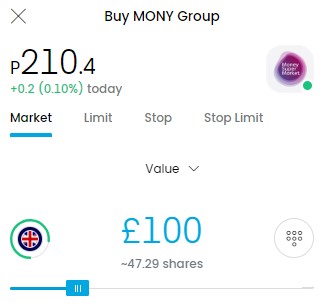

I have invested £100 in MONY Group (MoneySuperMarket). Some key information on MONY Group (MONY):

- Price Comparison Service: MoneySuperMarket is a leading UK-based price comparison website that helps users compare prices for various financial products and services, including insurance, loans, credit cards, and energy bills.

- Wide Range of Products: The platform covers numerous sectors such as car insurance, home insurance, travel insurance, mortgages, broadband, and utility bills, making it a one-stop shop for personal finance needs.

- Free to Use: Users can access the platform for free to search, compare, and find the best deals on financial services, with the platform earning commissions from providers rather than charging users.

- MoneySaving Expert Affiliation: MoneySuperMarket is affiliated with MoneySavingExpert, a consumer finance website that offers independent advice, which adds credibility and trustworthiness to the brand.

- Exclusive Offers: The platform often provides exclusive deals and discounts that are not available directly through providers, offering additional savings for consumers.

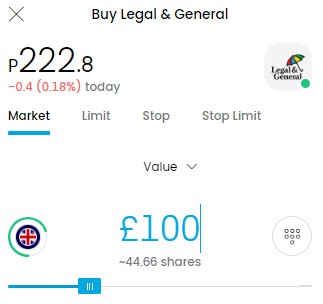

I have invested £100 in Legal & General. Some key information on Legal & General (LGEN):

- Founded in 1836: Legal & General Group PLC is a leading UK-based multinational financial services company with a long history in providing insurance, investment management, and retirement solutions.

- Strong Focus on Asset Management: Legal & General Investment Management (LGIM) is one of the largest institutional investment managers globally, managing assets for pension funds, sovereign wealth funds, and other institutions.

- Market Leadership in Insurance: The company is a market leader in life insurance, pensions, and annuities in the UK, offering products tailored to individual and corporate clients.

- Sustainability and ESG Initiatives: Legal & General is committed to integrating Environmental, Social, and Governance (ESG) principles in its investment strategy and business operations, advocating for long-term sustainable growth.

- Global Presence: Though primarily a UK-focused business, Legal & General has expanded its operations internationally, with a strong presence in the US and other markets through its investment management and insurance divisions.

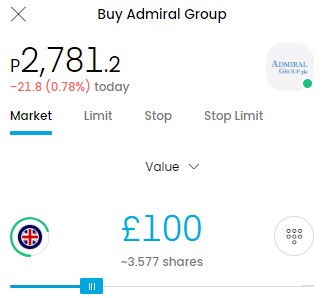

I have invested £100 in Admiral Group. Some key information on Admiral Group (ADM):

- Insurance Specialist: Admiral Group is a British company primarily known for its expertise in providing car insurance, but it also offers home, travel, and pet insurance products.

- Strong Dividend History: Admiral has a consistent track record of paying attractive dividends, making it appealing to income-focused investors.

- International Operations: While based in the UK, Admiral Group has expanded its operations internationally, with a presence in Spain, France, Italy, and the United States through its subsidiary brands.

- Focus on Technology: Admiral emphasizes digital innovation, using technology and data analytics to enhance customer service, improve risk management, and streamline operations.

- Strong Financials: Despite a competitive insurance market, Admiral maintains solid financial performance, with steady revenue growth and a robust balance sheet, contributing to its reputation for reliability.

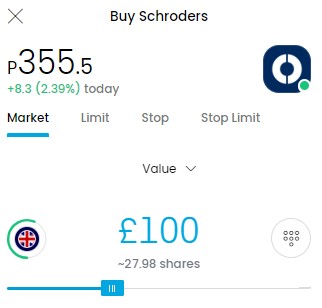

I have invested £100 in Schroders. Some key information on Schroders (SDR):

- Global Asset Management Firm: Schroders is a British multinational asset management company founded in 1804, with a strong focus on providing investment management services globally, including equities, fixed income, and alternatives.

- Sustainability Focus: Schroders places a significant emphasis on sustainable investing, integrating Environmental, Social, and Governance (ESG) factors into their investment decisions, and offering a range of ESG-related products.

- Extensive Client Base: The company serves a wide range of clients, including institutions, intermediaries, and retail investors, with over £700 billion in assets under management (AUM) as of 2023.

- Innovative Investment Strategies: Schroders is known for its active investment strategies, aiming to outperform the market through in-depth research, strategic asset allocation, and data-driven insights.

- Diversified Global Reach: Schroders operates in over 30 countries, giving it access to a broad range of markets and investment opportunities, catering to a diverse clientele across different regions.

I have invested £100 in BAE Systems. Some key information on BAE Systems (BA):

- Global Defense Contractor: BAE Systems is one of the world’s largest defense and aerospace companies, providing services and products to governments, primarily in the UK, US, and other NATO allies.

- Specializes in Advanced Technology: The company develops cutting-edge technologies, including cybersecurity solutions, electronic warfare systems, military vehicles, naval systems, and advanced aircraft like the Eurofighter Typhoon.

- Strong US Presence: A significant portion of BAE Systems’ revenue comes from its US-based subsidiary, making it a critical player in the American defense sector.

- Sustainability and Innovation Focus: BAE Systems is investing heavily in sustainable technology, including autonomous systems, low-carbon technology, and AI-driven solutions, aligning with future military needs.

- Consistent Financial Performance: BAE has shown resilient financial performance, with long-term contracts and a strong backlog, ensuring revenue stability and dividend growth for shareholders.

I have invested £25 in AstraZeneca. Some key information on AstraZeneca (AZN):

- Global Biopharmaceutical Leader: AstraZeneca is a leading biopharmaceutical company focused on the discovery, development, and commercialization of prescription medicines, primarily for the treatment of diseases in areas like oncology, cardiovascular, renal, respiratory, and immunology.

- Strong Oncology Portfolio: AstraZeneca is well-known for its innovative cancer therapies. Its oncology division is one of the fastest-growing segments, with successful drugs like Tagrisso (lung cancer) and Lynparza (breast and ovarian cancer).

- COVID-19 Vaccine: AstraZeneca gained global attention during the COVID-19 pandemic with its vaccine developed in partnership with Oxford University. Despite challenges related to distribution and rare side effects, the vaccine played a crucial role in global immunization efforts.

- Strategic Partnerships & Acquisitions: The company has made significant acquisitions and partnerships to bolster its pipeline and innovation, including buying Alexion Pharmaceuticals to strengthen its rare disease treatment portfolio.

- Sustainability and R&D Focus: AstraZeneca invests heavily in research and development, focusing on long-term growth and scientific innovation. It also has strong commitments to sustainability, aiming to achieve zero carbon emissions by 2025 through its “Ambition Zero Carbon” initiative.

I had £4.50 left in available cash, so I decided to buy stock in Greencoat UK Wind. They are currently paying a dividend of 5.10%. Dividends are paid quarterly, in November, February, May, and August.

I have not included Greencoat UK Wind on the monthly tables above, as it was bought with leftover change whilst I was writing this blog post.

Some key information on Greencoat UK Wind ( UKW):

- Renewable Energy Focus: Greencoat UK Wind is a leading renewable infrastructure fund, focusing solely on investing in UK wind farms, providing clean energy and contributing to the country’s renewable energy targets.

- Stable Income: The company generates stable, inflation-linked cash flows by selling electricity generated from wind assets, often under long-term contracts or power purchase agreements (PPAs).

- Dividend Growth: It aims to deliver steady income to shareholders with a progressive dividend policy. Dividends are largely covered by operational cash flows, making it attractive to income-focused investors.

- Portfolio: Greencoat UK Wind holds a diversified portfolio of onshore and offshore wind farms, reducing risk through geographical and asset-type diversification across the UK.

- Long-term Growth: The company benefits from increasing demand for renewable energy and government support for green energy initiatives, positioning it well for long-term sustainable growth.

All of my stock purchases are inside my Stocks ISA in Trading 212. This account will allow you to invest £20,000 in stocks tax-free every year. The dividends for the stocks that you invest in will also be tax-free.

There will be no capital gains tax or dividend tax. You will be allowed to re-invest your dividend earnings and also invest £20,000 additional every year.

Once I have more than £20,000 yearly to invest, I will start looking into investing in other passive income streams. For now, I will stick with the Trading 212 Stocks ISA.

My Stock Investing Plans For The Future

I will be buying more UK-based dividend stocks and also adding to the ones that I am currently holding. I will also look at diversifying my portfolio with international stocks.

I will look into diversifying the sectors that I am invested in to guard against possible upsets in various sectors. Once I have built up a sizable dividend stock portfolio, I will look at investing for growth.

This post has taken up a significant amount of time. I have managed to start my dividend stocks portfolio and have shared it with you in this post.

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor. Click Here to read disclaimer.

If you found value in this post and want to support my work, Click Here to buy me a coffee.

Subscribe to my list for valuable updates, tools, videos and articles that I will share as I come across them.

Let me know your thoughts on this post via the comments section. You can also add your insights and suggestions.

If you enjoyed reading this post or it added some value, please share it with others.

Follow My Journey And Get Inspired To Transform Your Life For The Better

“I may earn commissions as an affiliate from sponsored links within this post”