A monthly passive income of £3,000 will enable most people to pay for their living expenses. I will explore how this can be achieved in this post.

Why Passive Income?

Passive income will enable you to stop trading your time for money. It will allow you to leave the rat race called “a job”. You will have the time-freedom to do the things you desire, without being tied down for 8 to 12 hours daily at your job.

In case you are not familiar with the concept of passive income, it is income earned from an asset you own. It can be in the form of rental income from a property you own. It can be income in the form of royalties from the sales of a book that you have written.

The easiest way of generating passive income is from investments in the form of dividends payed out on stocks that you hold. The only problem with this is that most people don’t have much capital to invest in stocks.

If you have the patience to take advantage of compounding, you can build up a sizable holding in stocks to earn you an ongoing passive income that can take care of your monthly living expenses.

I have created an online account with Trading 212 that will allow me to trade stocks commission-free. I will focus on building a portfolio of stocks that will enable me to cover my monthly living expenses soon from dividend pay outs.

I have worked out that, I will need £3,000 monthly to cover my monthly expenses. This amount will enable most people in the UK to cover their monthly expenses. I know it will not allow for a lavish lifestyle, but it can free you from the chains of trading time for money (your job).

Do you want to get free shares worth up to £100? Join Trading 212 Invest with my link, and we will both get free shares.

The Power Of Compounding

A monthly passive income of £3,000 equates to earning £36,000 yearly. Let’s work out how much we will need to invest in stocks to earn this amount.

Taking an average of 4% annual return in dividends, it would take an investment of £900,000 to earn an annual dividend of £36,000.

It will take £900,000 invested to earn a monthly passive income of £3,000. This amount will shock most people, but a small number of people have achieved this.

Let’s see how we can get to this figure…

Firstly we should take advantage of the Stocks ISA in Trading 212. This account will allow you to invest £20,000 in stocks tax-free every year. The dividends for the stocks that you invest in will also be tax-free.

There will be no capital gains tax or dividend tax. You will be allowed to re-invest your dividend earnings and also invest £20,000 additional every year.

Let’s work out how many years it will take to reach £900,000 by investing £20,000 yearly at a 4% dividend pay-out.

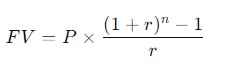

We can use the future value of a series formula:

Where:

- FV is the future value (£900,000),

- P is the annual investment (£20,000),

- r is the annual dividend rate (4% or 0.04),

- n is the number of years.

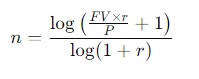

Rearranging this formula to solve for n:

n works out to approximately 26.25 years, or about 26 years and 3 months, to reach £900.000 by investing £20,000 annually at a 4% dividend pay-out.

This would be ideal for a person who joined a high-paying job at the age of 21. Let’s say they were earning £50,000 annually, they could live on £30,000 and invest £20,000.

They could be earning a monthly passive income of £36,000 by the age of 47. This is a perfect world example, only a small number of people are on high wages and a smaller number start investing at the age of 21.

Dividend Investing Combined With Value Investing

In reality, we should try and get a dividend return (dividend investing) close to 10% and also take into account the increase in the price of the stocks that we hold (value investing).

Our goal of reaching £900,000 will be achieved using a combination of dividend investing and value investing.

Let’s take a look at how the value of some stocks can increase over time.

How much would you have now if you invested £10000 in Ashtead Group 10 years ago?

To calculate how much a £10,000 investment in Ashtead Group made 10 years ago would be worth today, let’s break it down:

- Ashtead Group stock price in October 2014:

In October 2014, Ashtead Group’s stock price was approximately £10 per share. - Ashtead Group stock price today (October 2024):

As of today, Ashtead Group is trading at approximately £500 per share.

Calculation:

- In October 2014, with £10,000, you could have bought 1,000 shares of Ashtead Group at £10 per share.

- Today, those 1,000 shares would be worth approximately £500,000 (1,000 * £500).

If you had invested £10,000 in Ashtead Group 10 years ago, your investment could now be worth approximately £500,000.

This is a simplified estimate and does not account for transaction fees, taxes, or dividend reinvestment (Ashtead Group does pay dividends, which could further increase your total return if reinvested).

I am currently over half a century in years, I don’t have £20,000 a year to invest in stocks and time is not on my side. I will have to boost my investments by creating other online income streams.

I will funnel all my additional income streams into building my dividend stock portfolio using Trading 212. I will start with £1,000 to build a mainly UK-based dividend-paying stocks portfolio.

My goal is to reach and take advantage of the £20,000 tax-free yearly investment allowance as soon as possible.

Some Investment Number Crunching

Let’s look at some examples for illustration purposes….

If £20,000 is invested yearly and compounded at 10% for 10 years, the investment would grow to approximately £318,748.49.

If £20,000 is invested yearly and compounded at 10% for 15 years, the investment would grow to approximately £635,449.63

If £20,000 is invested yearly and compounded at 12% for 10 years, the investment would grow to approximately £350,974.70

If £20,000 is invested yearly and compounded at 12% for 15 years, the investment would grow to approximately £745,594.29

If £20,000 is invested yearly and compounded at 15% for 10 years, the investment would grow to approximately £406,074.36

If £20,000 is invested yearly and compounded at 15% for 15 years, the investment would grow to approximately £951,608.22

All investments involve a risk and you should carry out your own research before making any investments. I will be building my own dividend-paying stocks portfolio using Trading 212. I will post updates on this blog, these updates will show how my portfolio is building up.

My posts are not to be taken as financial advice, as I am just an ordinary guy trying my luck on the stock market. The better informed you are the luckier you will get, take the time and effort to do your own research.

My Initial Dividend Goals

I am working on a 12-Step Goal of earning a daily dividend equivalent to each of the denominations of English currency is steps.

Daily dividend earnings of: 1p, 2p, 5p, 10p, 20p, 50p, £1, £2, £5, £10, £20 and £50.

I am going to work out the dividends at a rate of 4% to be on the realistic side.

Copper Coins

Step 1: A daily dividend of 1p will require an investment of approximately £92

Step 2: A daily dividend of 2p will require an investment of approximately £183

Silver Coins

Step 3: A daily dividend of 5p will require an investment of approximately £457

Step 4: A daily dividend of 10p will require an investment of approximately £913

Step 5: A daily dividend of 20p will require an investment of approximately £1,825

Step 6: A daily dividend of 50p will require an investment of approximately £4,563

Metal Pounds

Step 7: A daily dividend of £1 will require an investment of approximately £9,125

Step 8: A daily dividend of £2 will require an investment of approximately £18,250

Paper Notes

Step 9: A daily dividend of £5 will require an investment of approximately £45,625

Step 10: A daily dividend of £10 will require an investment of approximately £91,250

Step 11: A daily dividend of £20 will require an investment of approximately £182,500

Step 12: A daily dividend of £50 will require an investment of approximately £456,250

I should reach Step 4 (10p daily) on the 5th of October 2024, as I will be investing approximately £1,000 in UK dividend-paying stocks.

I aim to reach Step 5 (20p daily) by 31st December 2024. Let’s see how long it will take me to reach Step 7 (£1 daily).

Once I reach Step 12 (£50 daily), I will have created enough momentum to get me to a daily dividend of approximately £100 to enable me to quit my current employment.

I will most likely quit my current employment once I reach Step 12 (£50 daily), as I will have created enough momentum and other passive income streams to cover my monthly expenses.

If anyone has £18,250 to invest, they can easily move into Step 8 (£2 daily) and also take advantage of the Stocks ISA in Trading 212.

The best time to invest was yesterday, the second-best time is now. Compounding is the best money hack, your money makes money for you while you do absolutely nothing.

You get your money working for you, instead of working for your money. That’s the biggest difference between the poor and the wealthy. The poor work for money, whilst the wealthy have their money working for them.

I was never taught these lessons in my early days. I have started transforming my mindset related to money, better later than never.

I have made many bad decisions related to money, had I learned from my mistakes, I would not be in the situation that I am currently in.

It is never too late to learn from your mistakes, even if you don’t get much out of the lessons, you can still pass on the valuable insights to others.

I have made many mistakes in my life, not just related to money. I am on a mission to learn from my mistakes and pass on the lessons to others via the posts on this blog.

I will continue working on improving all areas of my life. The priority is to establish passive income streams to will enable me to have more time freedom.

I would like to focus on the journey that I have commenced on and share the fruits of wisdom with others along the way.

You get to taste both bitterness and sweetness in life, the sweetness is intensified by the bitterness. I have experienced rock-bottom and the only way is up. If you are stuck in a rut, you can learn more from the lessons shared by someone who is finding a way out of the rut than from someone that has never been in the rut,

The words above may not be poetically expressed, but I hope you can understand the message they convey.

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor. Click Here to read disclaimer.

If you found value in this post and want to support my work, Click Here to buy me a coffee.

Subscribe to my list for valuable updates, tools, videos and articles that I will share as I come across them.

Let me know your thoughts on this post via the comments section. You can also add your insights and suggestions.

If you enjoyed reading this post or it added some value, please share it with others.

Follow My Journey And Get Inspired To Transform Your Life For The Better

“I may earn commissions as an affiliate from sponsored links within this post”